Global consultancy Larive International, in partnership with LightCastle Partners, is transforming Bangladesh’s poultry, fisheries, and livestock sectors with Dutch expertise and local execution.

In an interview with AgriNews24.com, Ms. Laura Derks, Senior Advisor at Larive, said initiatives like FoodTechBangladesh and PoultryTechBangladesh are boosting farmer productivity and sustainability.

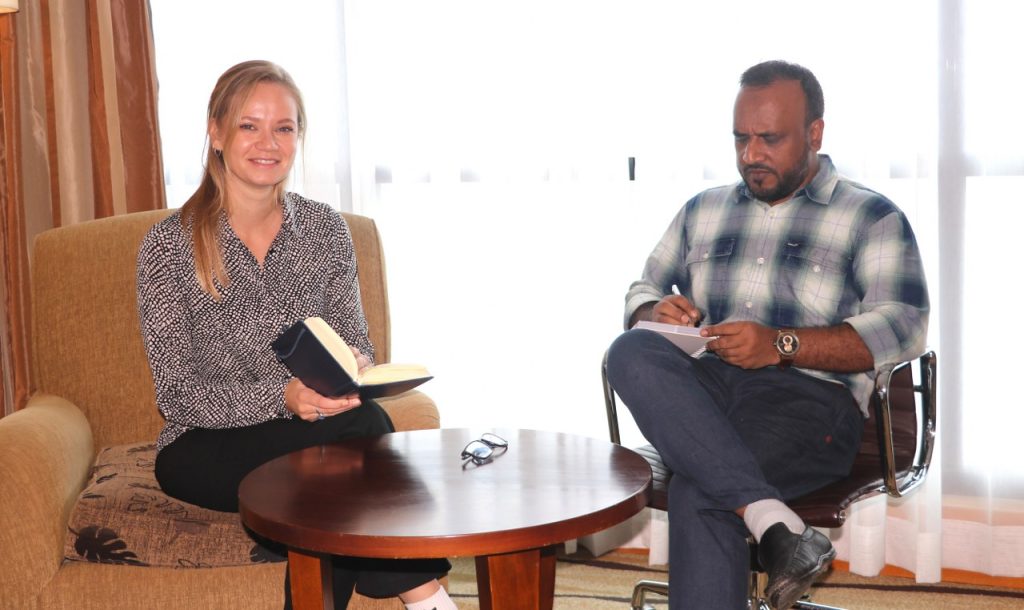

The following interview with Ms. Laura Derks, Senior Advisor for Emerging Markets at Larive International, has been presented to our readers. The interview was conducted by Mr. Md. Khorshed Alam Jewel, Editor & CEO of AgriNews24.com.

AgriNews24.com: Could you please give us an overview of Larive International’s global activities and areas of expertise?

Ms. Laura Derks : Larive International assists companies enter and grow in emerging markets. We work through long-standing local partners and our own offices, combining market intelligence, strategy, investment roadmaps, value-chain development and transaction advisory. Our focus areas are:

- Agri-food: aquaculture, livestock, poultry, feed, processing, cold chain

- Energy & renewables: solar, storage, efficiency, clean cooking/LPG, small-scale LNG, biomass

- Manufacturing & mobility: supplier localisation, OEM partnerships, M&A

We blend private advisory and implementation (e.g., market scans, partner search, due diligence, M&A support) with public–private programmes to de-risk expansion and speed up adoption.

AgriNews24.com: How long has Larive International been working in Bangladesh, particularly in the poultry, fisheries and livestock sectors?

Ms. Laura Derks : Active since 2019; since 2020 we operate via an exclusive partnership with LightCastle Partners. We pair Dutch technical know-how with strong local execution across mainly the poultry, aquaculture/fisheries, livestock and energy sectors.

AgriNews24.com: What are some of the most significant projects or contributions that Larive has made in Bangladesh so far?

- FoodTechBangladesh: demonstration-led farmer training; better productivity and post-harvest practices.

- PoultryTechBangladesh: efficiency and sustainability upgrades in hatchery, feed, processing and cold chain.

- De Heus: investment-grade market entry assessment for aquafeed/livestock.

- Nutreco: shrimp value-chain assessments across Asia, incl. Bangladesh.

- BekaertDeslee: market sizing and competitor analysis to support entry decisions.

- SHV Energy: market entry & M&A strategy in Asia/Africa (LPG, small-scale LNG, biomass).

- Bill & Melinda Gates Foundation: recurring monthly analyses of digital payments and financial services in South Asia and Africa.

AgriNews24.com: What is your assessment of Bangladesh’s fisheries sector and what opportunities or challenges do you see for its sustainable growth?

Ms. Laura Derks : Aquaculture and fisheries are central to Bangladesh’s food security, rural incomes and affordable protein supply. The sector benefits from strong domestic demand and a deep base of experienced farmers.

Its growth trajectory is shaped by broader country dynamics: currency and import restrictions, energy tariffs and reliability, limited finance/insurance, logistics outside main corridors, and climate risks (flooding, salinity).

Against these challenges, the opportunity is to lift productivity and resilience at farm level while building reliable pathways to value-added markets, such as the Dutch Market. For Bangladesh, the Netherlands is the second biggest export market worldwide. The Netherlands is the corridor to the rest of Europe and there is the opportunity.

The upside is clear, raise farm productivity and resilience and link reliably to value-added domestic and export markets. Priority actions are dependable seed/genetics, consistent feed quality, simple but disciplined farm management (stocking density, feeding to growth curves, basic water-quality monitoring and aeration) and professionalised hatcheries/nurseries.

Tilapia is well placed to expand with national and international demand, carp value chains remain a domestic main product and can climb the value ladder through better grading and chilling and shrimp can grow where PL reliability, biosecurity and export compliance are secured. Climate adaptation (salinity-tolerant species, better embankments/drainage, heat-aware stocking) should be a another key focus.

Domestic markets benefit from clear grades and freshness standards; exports need HACCP and, where relevant, ASC/MSC-aligned practices and traceability to unlock premium markets.

AgriNews24.com: To what extent is Larive directly involved with farmers on the ground and how do farmers benefit from your initiatives?

Ms. Laura Derks :Very directly. We use demonstration sites, field days and trainer-of-trainers. Curricula are co-developed with technical experts and localised with LightCastle. Farmers typically achieve higher survival and growth, better feed use and quality and lower cost per kg plus stronger market access.

Our Farmers App helps track practical KPIs (survival, growth rate, cost/kg) and links training to follow-up technical assistance. Do you want to sign up for the app? Get into touch with our programme!

AgriNews24.com: Looking ahead, how do you envision the overall animal protein sector (poultry, fisheries, and livestock) in Bangladesh in the coming years?

Ms. Laura Derks : Demand prospects are positive, though costs and finance remain challenging. Notably, the Business Confidence Index (BCI), developed by LightCastle Partners (LCP), shows the primary sector regaining confidence, poultry & livestock score +14.2, aquaculture +8.29.

- Poultry: key to food security and jobs (~1.6% of GDP). Priorities: better supply–demand planning, stronger biosecurity, certified slaughter, reliable cold chain; selective export-readiness.

- Aquaculture: lower unit costs (feed/energy), dependable seed and simple tech upgrades (feeding to growth curves, targeted aeration, basic water-quality monitoring). Tilapia rising; shrimp depends on PL quality and compliance; carp/pangasius have underused export potential with improved product form and consistency.

- Aquaculture: lower unit costs (feed/energy), dependable seed and tech upgrades (feeding to growth curves, targeted aeration, basic water-quality monitoring). Shrimp export development hinges on reliable PL supply, farm/hatchery biosecurity, and lab & testing capacity (residues, pathogens, microbiology), harmonised standards and traceability, backed by cold chain. Tilapia is rising domestically; carp/pangasius have underused export potential with better product forms and consistency.

- Livestock/dairy: gains from feed and genetics, animal health, and investments in chilling/collection to stabilise quality and pricing.

Progress will be fastest where policy is predictable, finance fits sector cash cycles (including insurance), and PPP execution aligns demonstrations, local training and processor compliance.

Business Confidence Index Report 2024–25 | LightCastle Partners

AgriNews24.com: As a market expert, what weaknesses do you see in the market management of these sectors in Bangladesh and what recommendations would you suggest for improvement?

Ms. Laura Derks :Fix the data gap. Today, fragmented or lagged data (limited testing, inconsistent record-keeping) slows decisions and limits decision making. Put logs in place for survival, growth, FCR proxies, mortalities, treatments, energy use and basic water parameters. Even a weekly dashboard drives better stocking, feeding, and harvest timing.

- Tighten farm management and biosecurity. Inefficient routines raise feed costs and disease risk. Standardise daily tasks, feeding by weight/age and temperature, pond/house hygiene, footbaths, visitor control and train everyone, not just owners: youth and female staff included.

- Unlock genetics. Limited access to the right breeds/lines constrains performance. Facilitate reliable channels for improved broodstock, day-olds, fingerlings/PL and basic selection guidelines. Better genetics + good farm management = faster growth, better survival, and more uniform product.

- Cut energy OPEX with practical sustainability. High variable energy costs erode margins. Start with load mapping and efficiency (timers for aeration, efficient motors, insulation, maintenance), then layer in fit-for-purpose solar or hybrid solutions where payback is clear. Lower OPEX, steadier operations.